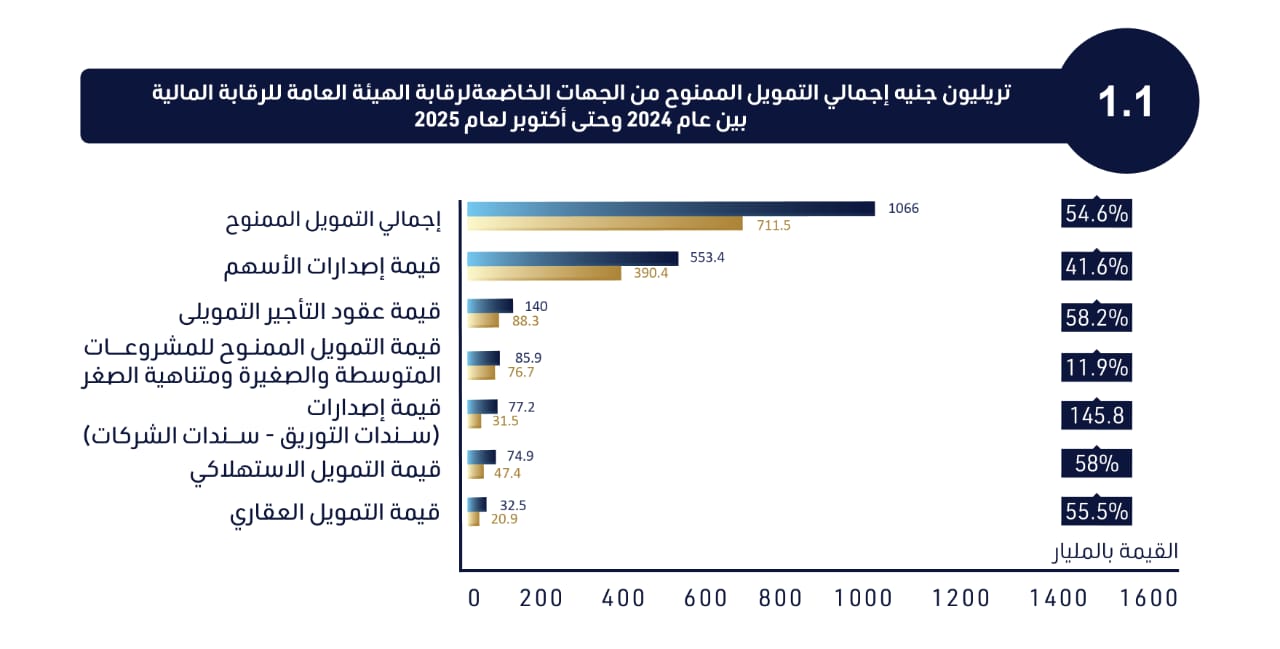

- Financing grew by 54.6% to reach EGP 1.1 Trillion between January and October 2025.

For the first, total financing granted by FRA-Regulated entities has exceeded EGP 1 Trillion.

Financing activities regulated by the Authority achieved a qualitative leap during January to October 2025, reaching approximately EGP 1.1 Trillion – a remarkable growth of 54.6% compared to the same period in 2024.

Moreover, financing activities have witnessed a remarkable 82.5% expansion since Dr. Mohamed Farid assumed the chairmanship in August 2022. Total financing volumes surged from EGP 584 billion at the end of 2022 to EGP 1.1 trillion during Jan–Oct 2025.

Sectoral Performance Breakdown (Jan–Oct 2025):

- Equity Capital Markets: Led with EGP 553.4 billion in share issuances, reflecting a growth of 41.6%.

- Financial Leasing: Reached EGP 139.9 billion, representing a growth of 58.2%.

- Factoring: Reached EGP 102 billion mark, showing a robust growth of 82.4%.

- MSME Financing: Totaled EGP 85.9 billion, marking a growth of 11.9%.

- Debt Instruments: Witnessed a massive surge, totaling EGP 77.2 billion with a growth of 145.8%.

- Consumer Finance: Reached EGP 74.9 billion, achieving a growth of 58%.

- Mortgage Finance: Reached EGP 32.5 billion, recording a growth of 55.5%.

- Moveable Collateral Registry: Witnessed a significant expansion, with registered assets valued at EGP 4 trillion, a growth of 39.8%.

- MSME Outstanding Portfolios: This growth is mirrored in the MSME sector, where portfolios reached EGP 93.8 billion, representing a growth of 27.1%.

These indicators reflect the resilience and sustainable growth of non-banking financial activities. They further highlight the vital role of the regulatory and legislative framework in facilitating financing flows, enhancing financial inclusion and stimulating economic activity across various sectors.

Tags: الرقابة المالية, الهيئة العامة للرقابة المالية, FRA, Financial Regulatory Authority, التمويلات الممنوحة, التريليون, الفترة من يناير إلى أكتوبر 2025, Financing Granted, Trillion, January - October 2025 Last modified: December 28, 2025