- The Authority firmly believes that trust must be more than a slogan; it must be a daily practice integrated into its policies and procedures.

- The discussion about the future of startups is incomplete without addressing exit mechanisms and IPOs (Initial Public Offerings) as one of the most important tools enabling these companies to grow and access sustainable financing.

- The SME market is an alternative for early-stage companies, providing support with fewer requirements than the main market.

- FRA is open to successful international experiences in all economic fields.

- Special Purpose Acquisition Companies (SPACs) serve as an innovative, non-traditional IPO route, giving startups a faster and simpler path to financial markets.

- Egypt has taken significant steps in improving the legal and regulatory environment in recent years.

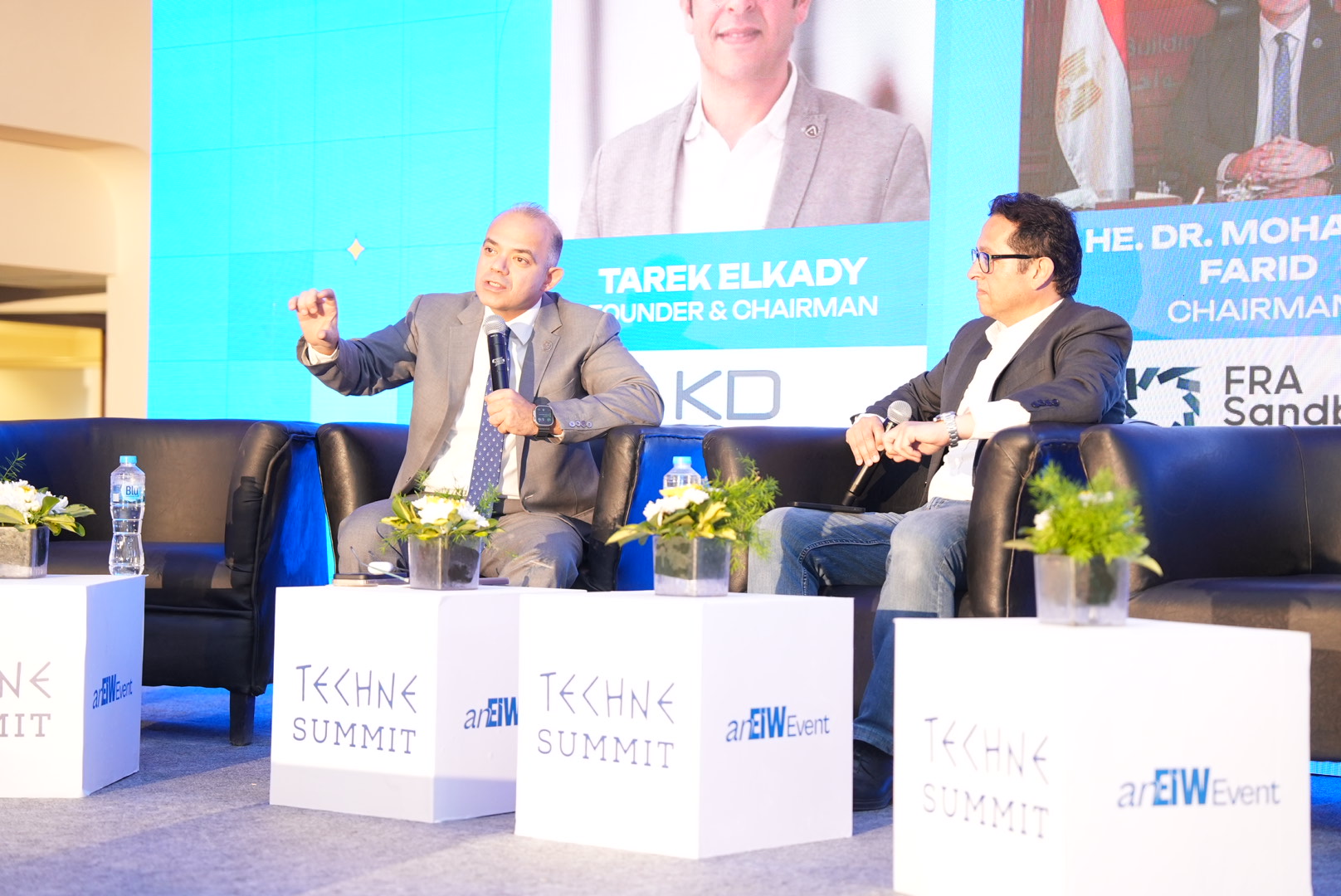

Dr. Mohamed Farid – FRA Chairman joined a panel discussion titled “From Startup to Stock Exchange: New Paths for Growth and Investment” during the launch of Egypt Innovation Week 2025. Held in conjunction with the Techne Summit at the historic Granada Palace, Dr. Farid’s participation underscored FRA’s firm commitment to cultivate innovation and entrepreneurship. The Authority aims to link startups with sustainable financing sources. He emphasized the central role of the non-banking financial sector in driving the new knowledge – and technology-based economy and urged attending entrepreneurs to focus on innovation and development

Eng. Tarek El Kady, Founder of Techne Summit, moderated the session, which attracted a large audience of entrepreneurs and Egyptian, Arab and foreign investors from various sectors.

Dr. Farid opened his speech by affirming that Egypt Innovation Week provides a crucial opportunity: it allows young entrepreneurs to turn ideas into successful projects, helps discover innovative and implementable solutions and offers the government and partners a chance to solidify the conviction that Egypt is steadily moving toward becoming a global hub for technological innovation.

He explained that the Authority’s drive to develop legislation and financial instruments goes beyond mere economic figures. Instead, it is fueled by the enthusiasm and determination he observes in young participants. He clarified that entrepreneurs view challenges not as obstacles, but as opportunities for innovation and new solutions. This belief in the youth’s ability to change reality is what motivates the Authority to continue providing a conducive and supportive environment that enables them to transform ideas into successful projects for Egypt’s future.

Dr. Mohamed Farid, FRA Chairman, emphasized the Authority’s foundational belief that trust is a daily practice, not just a motto, demonstrated through its policies. He stressed FRA’s dedication to constructive dialogue with all stakeholders, particularly entrepreneurs and youth. Recognizing the central role of startups in national growth, FRA actively supports them by simplifying procedures and developing dynamic regulations. Dr. Farid expressed appreciation for the direct input from young entrepreneurs, viewing it as essential for building a more inclusive, flexible and fair investment landscape.

Additionally, he asserted that the future of startups is directly tied to exit mechanisms and IPOs, which are vital for attracting long-term capital and strengthening competitiveness. He added that international best practices show the need for flexible financial and legislative frameworks that adapt to companies at every growth stage. To that end, he highlighted the existing tax benefits for listed companies and confirmed FRA is working with the Ministry of Finance to create an even more growth-supportive and attractive tax system for companies.

FRA Chairman pointed out that listing on the main market of the Egyptian Exchange (EGX) is the traditional and most common model, but it involves high requirements, including a large volume of business and capital reaching hundreds of millions of Egyptian pounds, making it suitable only for large companies. In contrast, the SME market was designed to support companies in their early growth stages with fewer requirements, though attracting investors there still depends on the companies’ ability to achieve high growth rates that may reach 30%, 40%, or even 100%.

He explained that Egypt is closely monitoring global developments in this field, especially in the United States, where innovative financing tools have emerged, such as Special Purpose Acquisition Companies (SPACs). These vehicles have spread in recent years as an alternative mechanism to the traditional IPO. These companies raise funds from investors through the stock exchange with the goal of acquiring or merging with an existing company, allowing startups faster and simpler access to financial markets.

He highlighted the Authority’s approval on the establishment of the first Special Purpose Acquisition (SPAC) venture capital company under Resolution No. 2323 of 2024. This step aims to open a new financing channel through the Egyptian Exchange for non-banking financial activities and digital platforms operating in the field of FinTech, given the opportunities for both the non-banking financial institutions sector and FinTech startups to expand the base of beneficiaries of non-banking financial activities.

Dr. Farid revealed that the Authority approved the SPAC experience but adapted it with an “Egyptian flavor” to better suit the local market. This novel model merges the philosophy of Venture Capital (VC) funds with public offerings, enabling the collective listing of a group of startups within a single portfolio on the stock exchange.

He added that this mechanism grants smaller companies, which would otherwise struggle to list individually, a fair opportunity for financing. It also benefits investors by offering risk diversification and boosting potential returns.

FRA Chairman stressed that the success of these new tools hinges on a flexible regulatory framework designed to strike a delicate balance between investor protection and facilitating startup growth. He confirmed the Authority is continually updating its regulations to introduce innovative financial instruments without undermining market stability or investor trust.

Also, he affirmed that the true challenge is not just tool innovation, but building an integrated system defined by advanced legislation, sound governance and financial transparency to enhance overall market trust.

Dr. Farid noted that Egypt has made tangible progress in recent years by improving its legal and regulatory environment. Regulatory bodies are now significantly more cooperative with companies that adhere to the law. He highlighted clear government support to simplify company registration and regulatory compliance, demonstrating a growing state awareness of the crucial role startups play in stimulating economic growth and creating job opportunities.

Dr. Mohamed Farid concluded by affirming that Egypt’s investment environment is moving in the right direction. He noted that the country benefits from a combination of talented youth, ambitious startups and a government serious about supporting legislative reforms. What is needed now is to continue on this path, leveraging tools like the SPAC, to create an advanced financial and investment environment capable of transforming Egypt into a regional and global hub for entrepreneurship and innovation.

Last modified: October 12, 2025