- Proposals shall be submitted through the Financial Regulatory Authority’s (FRA) website by the end of October.

- This public input will contribute to the ongoing strategic partnership between FRA and non-bank financial institutions, helping to enhance the effectiveness of financial regulations.

FRA is inviting non-bank financial companies under its supervision to review Basel III solvency standards. This opportunity allows companies to express their views and suggestions before the standards are implemented.

By participating, companies can help ensure that the standards align with the needs of the non-bank financial sector and support the sector’s contribution to the national economy.

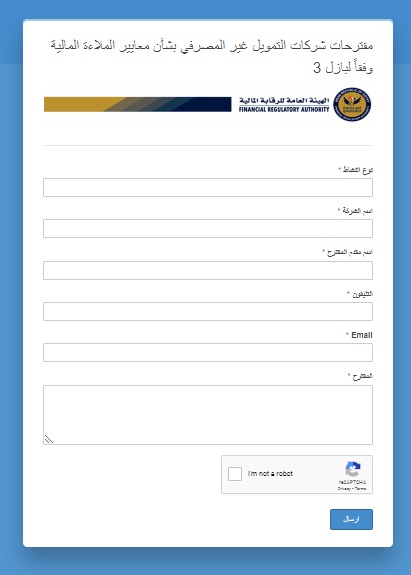

The Authority has established a direct communication platform for non-bank financial companies to submit proposals, inquiries, and requests regarding Basel III solvency standards. This platform provides a convenient way to share feedback and contribute to the development of the standards. Companies shall submit proposals and inquiries through the platform by the end of October, check the link below:

https://fra.gov.eg/company-suggestions

FRA aims to create a more inclusive and collaborative environment by encouraging direct communication with all relevant stakeholders, in line with global best practices.

FRA’s decision to solicit public input on Basel III standards reflects its commitment to a strategic partnership with non-bank financial institutions. By actively seeking feedback, FRA aims to enhance the effectiveness of its regulations and promote the development of the non-bank financial sector. This initiative also aligns with the Authority’s ongoing efforts to establish open and transparent communication channels that support its primary objective: ensuring financial stability through non-bank financial transactions.

The proposed Basel III standards for non-bank financial companies (NBFCs) encompass capital efficiency, leverage, and liquidity standards. These comprehensive standards are designed to assess risk management practices and measure the financial stability of both markets and individual NBFCs. By adopting these standards, NBFCs can enhance their competitiveness, attract investments, and contribute to sustainable financial inclusion while providing greater protection for their clients.

Last modified: October 17, 2024