- The program provided a comprehensive view of the international financial regulatory framework, focusing on applying global standards to complex financial products and risk management.

- Adherence to international standards is deemed crucial, serving as the core foundation for fostering investor confidence and ensuring market sustainability.

- The (NEXTGEN) program is designed for emerging markets to build regulatory capacity, drive financial innovation and foster market sustainability.

Dr. Mohamed Farid – FRA Chairman:

- Markets cannot develop sustainably or retain investor confidence without both excellent disclosure practices and unwavering adherence to established standards.

- Market strength relies on adhering to standards, adopting innovation and joint cross-border action for transparency, sustainability and efficiency.

Dr. Mohamed Farid, FRA Chairman and Chair of the IOSCO’s Growth and Emerging Markets Committee (GEMC) delivered a virtual lecture to participants in the “Navigating International Financial Regulation and Compliance” program at the Dickson Poon School of Law, King’s College London. Speaking as Vice Chair of the IOSCO, Dr. Farid focused on IOSCO’s global role in setting standards for securities market regulation and its priorities for growth and emerging markets.

The training program itself offers a comprehensive view of the international financial regulatory framework, clarifying the core rules and standards set by global bodies like the BCBS, FSB, FATF and IOSCO. The curriculum provides an in-depth analysis of complex financial products, including crypto-assets, derivatives and asset-backed securities, reviewing how regulatory requirements impact their structuring, trading and risk management, ultimately preparing specialists to operate effectively within the evolving regulatory landscape.

Dr. Farid initiated his lecture by acknowledging the significance of participating in the King’s College London program, noting his personal connection to the institution where he earned his Master’s degree in Law. Following a brief overview of his professional background in financial supervision and academia, he explained that his address was intended to support global efforts focused on building the capacity of regulatory bodies and exchanging expertise on optimal regulatory practices.

He emphasized that promoting financial market stability requires strict adherence to clear and transparent international standards, stating that “Markets cannot maintain investor confidence or develop sustainably without good disclosure and adherence to standards; disclosure is the cornerstone of financial stability and the first gateway to attract investment.”

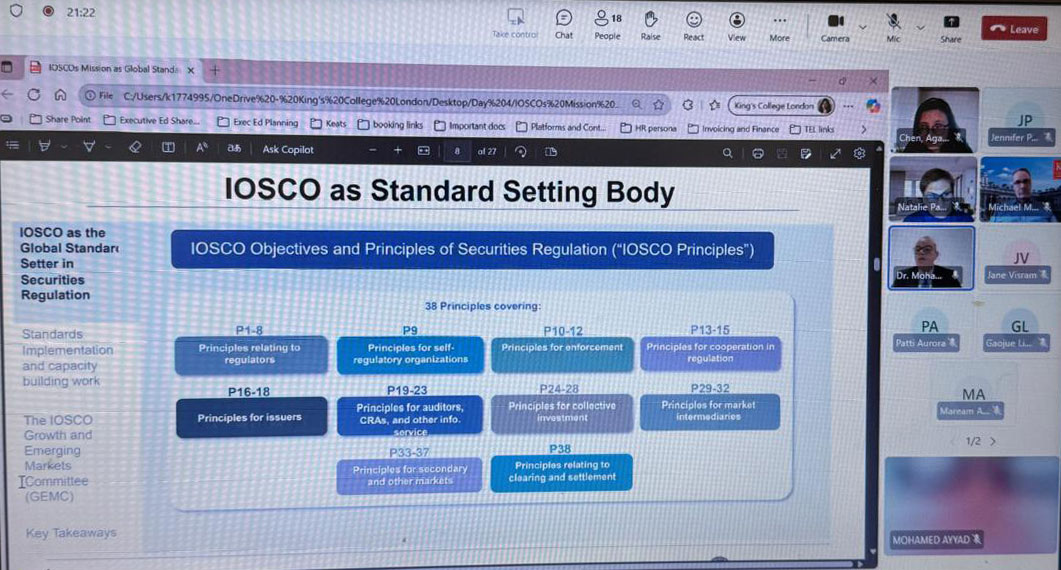

Dr. Farid then detailed the pivotal role of the IOSCO which regulates more than 95% of global securities markets. He highlighted that major global bodies internationally recognize IOSCO’s 38 Principles, including the G20 and the FSB, noting that IOSCO’s influence comes from its ability to build consensus across diverse legislative and development levels in markets.

Furthermore, he emphasized the broad scope of IOSCO’s standards, which encompass every market component, from regulatory bodies, issuers and credit rating agencies to investment funds, brokers, secondary markets, clearing and settlement. These standards, he concluded, are essential for protecting investors, ensuring fairness and efficiency and mitigating systemic risks.

Dr. Farid detailed how IOSCO sets standards via its 8 policy committees, emphasizing extensive consultation among global members and stakeholders. He highlighted the organization’s current focus areas, including secondary market disclosure, operational risks, crypto-asset regulation and challenges specific to emerging markets. Dr. Farid underscored that the true value of standards lies in their implementation, which is why IOSCO heavily monitors application.

In this regard, he cited findings from the IOSCO Standards Implementation Monitoring (ISIM) which revealed disparities in applying principles related to systemic risks and information exchange. Furthermore, joint reviews with the Financial Stability Board (FSB) on crypto-assets and stable coins emphasized the critical need for greater global consistency, cross-border cooperation and stronger enforcement.

The lecture concluded by detailing the NEXTGEN Capacity Building Program, launched by IOSCO in 2024 specifically to support developing markets. This program, which operates in cooperation with major international bodies including the World Bank, IMF and the Toronto Centre, provides specialized training, a global curriculum evaluation, a digital knowledge community and a wide expert base. Dr. Farid highlighted that NEXTGEN represents a qualitative leap in enhancing regulatory capabilities, with a particular focus on key areas such as Financial Technology (FinTech), market development and sustainability.

A key segment of Dr. Farid’s lecture focused on strengthening regulatory cooperation within IOSCO, citing essential tools like the MMoU and EMoU and the facilitating role of its regional committees (AMERC, APRC, ERC, IARC, and GEMC). He affirmed that emerging markets are a primary focus for the organization’s future, adding that the GEMC plays a vital role in ensuring these markets have a strong, amplified voice in the international standard-setting process.

Dr. Farid detailed the major initiatives of the Growth and Emerging Markets Committee (GEMC), starting with its 2020 report to the G20 on capital market development in emerging countries. This report identified core challenges in legal frameworks, governance, liquidity and bond market weakness, providing recommendations centered on capacity building, reform sequencing and the supportive role of FinTech. Furthermore, he highlighted the GEMC’s work on innovation facilitators, such as regulatory sandboxes and accelerators, offering recommendations for balanced regulation that successfully supports innovation while simultaneously mitigating risks. Finally, the discussion covered initiatives promoting financial inclusion, underscoring how FinTech is utilized to enhance access, reduce costs, increase transparency and build vital partnerships.

Dr. Farid reviewed the GEMC Network for Adoption or Other Use of ISSB Standards a key initiative launched by the Committee in December 2024 to assist emerging countries through training, technical assistance, and knowledge exchange in implementing the new global sustainability standards.

Dr. Farid concluded his lecture by affirming the central role of IOSCO in safeguarding global financial markets through standard development, implementation monitoring, capacity building and international cooperation. He underscored that the requirements of emerging markets represent a major pillar in the future of global financial regulation. He defined market strength as resting on continuous development, strict adherence to standards, adoption of innovation and joint action across borders, committing that IOSCO will continue to work through its specialized committees to ensure transparent, efficient and sustainable markets that serve investors and economies worldwide.

Last modified: November 25, 2025