- The meetings aimed to foster joint cooperation in training and qualification programs, alongside the crucial exchange of expertise to enhance and ensure market stability.

- These meetings were a key segment of an official Egyptian delegation’s visit to London, strategically timed with their participation in “Egypt Day” events at the London Stock Exchange and various meetings arranged by the Egyptian-British Business Association

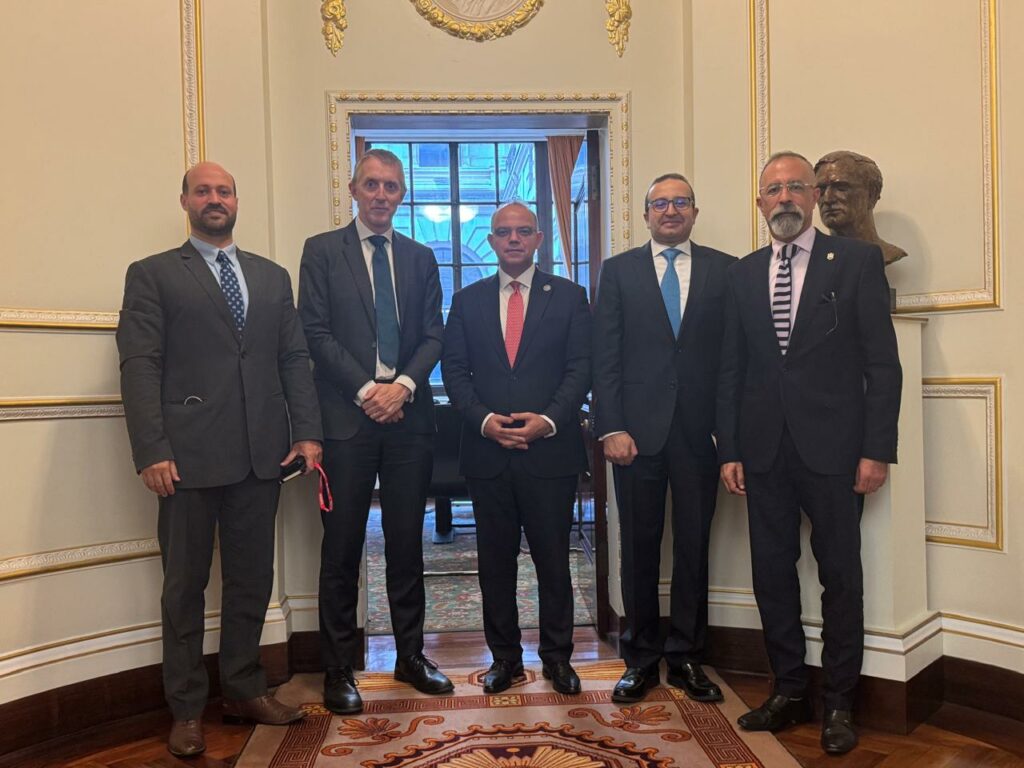

Dr. Mohamed Farid, FRA Chairman concluded a productive series of meetings in London today, part of an official delegation’s visit aimed at promoting Egypt’s ongoing economic reforms. Dr. Farid engaged with key figures, including Mr. Sam Woods, Deputy Governor for Prudential Regulation and leadership from The Chartered Insurance Institute (CII).

The core objective of these discussions was to explore avenues for joint cooperation in training and qualification and to exchange expertise crucial for enhancing market stability. These collaborative efforts are designed to boost the efficiency and competitiveness of Egypt’s non-banking financial markets and bolster their resilience.

These significant meetings were a central component of the Egyptian delegation’s broader activities in London. This included active participation in “Egypt Day” events at the London Stock Exchange and various high-profile meetings organized by the Egyptian-British Business Association (BEBA) under the theme “Egypt’s New Era: Investment Opportunities.”

During his visit, Dr. Farid also participated in the opening of a trading session at the London Stock Exchange, held meetings with prominent business leaders, investors and key figures in the UK and joined a panel discussion titled “Reforms as a Path to Business Leadership.” Further meetings were conducted with representatives of British and international banks, the wider financial and business community and international institutions like Jefferies.

During the meeting with the Chartered Insurance Institute (CII)—a globally renowned institution founded in 1912 that offers a comprehensive spectrum of training programs and professional certifications, from foundational levels to the esteemed Fellowship—Dr. Farid, acting as the Chairman of the Financial Services Institute (FSI) (FRA’s dedicated training arm), delved into potential areas for collaboration. These discussions specifically focused on professional certifications, short-term training courses, and remote learning initiatives between the two institutes.

Dr. Farid also highlighted a recently signed Memorandum of Understanding (MoU) between FRA’s Financial Services Institute and Bayes Business School (City, University of London). This MoU, formalized at the Egyptian Embassy in London, is a direct result of a protocol with Egyptian insurance companies. Its primary goal is to enhance the capabilities and competitiveness of leaders within Egypt’s insurance sector, aligning with FRA’s strategic vision for professional development in non-banking financial activities and ensuring the sector’s advancement amidst global changes.

The comprehensive program under this new partnership will cover vital subjects, including corporate leadership in the age of technological transformation, developing strategic thinking in a digital environment, formulating institutional change strategies, and designing innovative, adaptable business models for the rapidly evolving insurance landscape. The program is set to be held twice annually at the university’s London campus, overseen by a distinguished group of international academics and practitioners specializing in digital leadership and strategy.

Dr. Farid further detailed FRA’s recent legislative achievements, highlighting the issuance of Unified Insurance Law No. 155 of 2024. He described this law as a transformative step for the Egyptian insurance sector, designed to unify the legal and regulatory framework, enhance supervisory efficiency and ultimately contribute to better regulation of non-banking financial markets and greater financial inclusion. The law comprehensively covers insurance, reinsurance and all related supporting services and professions.

Under this new legislation, FRA has already implemented key regulatory decisions. These include setting minimum capital requirements for companies operating in insurance-related activities. Notably, insurance companies are now mandated to increase their minimum issued and paid-up capital in two phases: to EGP 400 million within one year, and further to EGP 600 million by the end of the second year from the decision’s effective date.

Additionally, the new regulations introduce specific rules and ratios for investing insurance and reinsurance company funds. These measures are designed to balance returns with risks, optimize asset management and ensure timely preparation of financial statements for all companies and insurance pools, thereby bolstering transparency and financial governance.

In his meeting with Mr. Sam Woods, Deputy Governor of the Bank of England for Prudential Regulation, Dr. Farid underscored FRA’s crucial role in prudential supervision of non-banking financial institutions. He emphasized the Authority’s use of robust regulatory tools aimed at mitigating systemic risks, ensuring overall financial stability, and strengthening the resilience of all supervised entities.

He elaborated that macro-prudential supervision is focused on identifying and mitigating systemic risks that could jeopardize the entire financial system. This includes pinpointing issues like concentrated credit exposure or severe market volatility, and analyzing the intricate connections between various sectors, such as the relationship between non-banking financial institutions and banks, to assess the potential ripple effects of global crises.

He further underscored the importance of micro-prudential supervision, which involves closely monitoring the financial health of individual institutions. This ensures each entity complies with crucial capital, liquidity, and governance requirements. This level of oversight includes reviewing internal risk management frameworks and meticulously examining financial statements to confirm adequate provisioning and high-quality assets, all vital for maintaining institutional stability and financial soundness.

Dr. Farid affirmed FRA’s unwavering commitment to issue explicit regulatory directives that compel companies to uphold the highest standards of governance and accountability. This commitment extends to establishing precise rules for managing both operational and credit risks and actively encouraging institutions to conduct rigorous financial stress testing to gauge their resilience against potential shocks.

In his concluding remarks, he highlighted that enhanced transparency is a cornerstone of FRA’s strategy. The Authority mandates non-banking financial institutions to publish regular reports detailing their financial status and risk profiles. This adherence to strict financial disclosure and governance rules is meticulously monitored, fostering greater market clarity, improving efficiency and ultimately bolstering the confidence of both investors and consumers.

Last modified: July 27, 2025